2021. 7. 9. 02:43ㆍ카테고리 없음

You are in

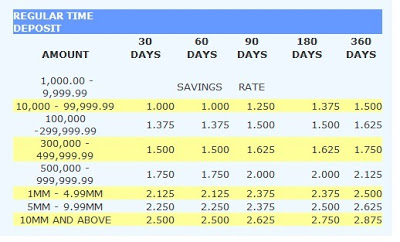

Dollar Time Deposit. 30, 60, 90, 180, 360 Days. Subject to pretermination penalty. 15% (1) (1) The revised Withholding Tax for Interest Earned is effective January 1, 2018. A more detailed. View time deposit rates. 365 Days: 2 Years: 1K to less than 10K: 0.0000.

Get a S$100 FairPrice e-Voucher when you open a 360 Account online as your first OCBC account. Promotion ends on 31 March 2021.

Estimate how much your affordability, valuation and rental yield in one single calculator.

Invest and protect with a regular premium investment-linked insurance plan.

Trade around the world with access to 29 global exchanges and diversify with Futures and Leveraged FX.

You can open an OCBC Securities account at any OCBC Bank branch.

Invest effortlessly from just US$100.

Now on the OCBC Mobile Banking app.

Time Deposit Rates Usa

eCompareMo partners with the leading banks to provide you with impartial and up-to-date information on all financial products in the country. With our state-of-the-art time deposit calculator, you can compare and contrast all time deposit interest rates in the Philippines to find the best one that can give your investment a head start.

What is a time deposit?

A time deposit, or a certificate of time deposit, is an interest-bearing bank deposit that has a specified date of maturity. It is a bank account type option for customers who would like to deposit available excess funds in a high-interest account type. This is issued for a specified term, such as 30 days (minimum) up to five years. Funds can be withdrawn without prior notice, or before the maturity date, though there are penalties for early withdrawal.

Forms of deposit can be through cash, check (personal or managers check) and fund transfer from an existing account maintained at the same bank where the time deposit will be placed.

Why do I need to open a time deposit account?

The more money you invest in a time deposit, the more you'll earn. Also, with its better interest rates, one of the benefits of time deposit is it secures higher yields from your savings. Choose from any type of time deposits—traditional, mutual fund, fixed, term deposit with interim interest, flexible—and let your money grow.

How to open a time deposit account

Our advanced calculation engine allows users to make a fast and easy comparison of all time deposit interest rates offered by banks in the Philippines—guaranteed free. Applicants can get detailed information, such as minimum initial placement, placement term, withholding tax, rollover allowance, certificate of time deposit, and other requirements.

After doing a comparison using eCompareMo’s time deposit interest rate calculator, you can immediately invest for a time deposit online. By using our platform, you can save time and money in choosing the right time deposit account.

To open a time deposit account, all you need is a digitized ID, such as an SSS ID, Driver’s License, Voter’s ID, Company ID, and the like.

Receive top-notch support from our customer service agents

Time Deposit Rates Wells Fargo

Our customer helpdesk is more than willing to answer your questions regarding the product/s of your choice. Our highly trained agents also provide you with financial advice and other information that will help you make an informed decision about time deposit.

Data security is our top priority

Your security is paramount to us, that’s why at eCompareMo, we use global standards in data privacy and security. With an encrypted data protection system, you can be sure that all your personal information is protected. We will never share any of your data with other parties without your consent.

Helping millions of Filipinos save time and money

eCompareMo helps Filipinos achieve financial freedom through financial products and services. By using our service, customers can simplify their process of searching for the best products that are tailored to their wants and needs.

Aside from financial comparison services, we also provide insightful, informative, and inspirational articles as well as social media campaigns that aim to reach out to people looking for financial freedom in their lives.

Union Bank Time Deposit Rates

With eCompareMo, opening a time deposit account in the Philippines has never been easier.